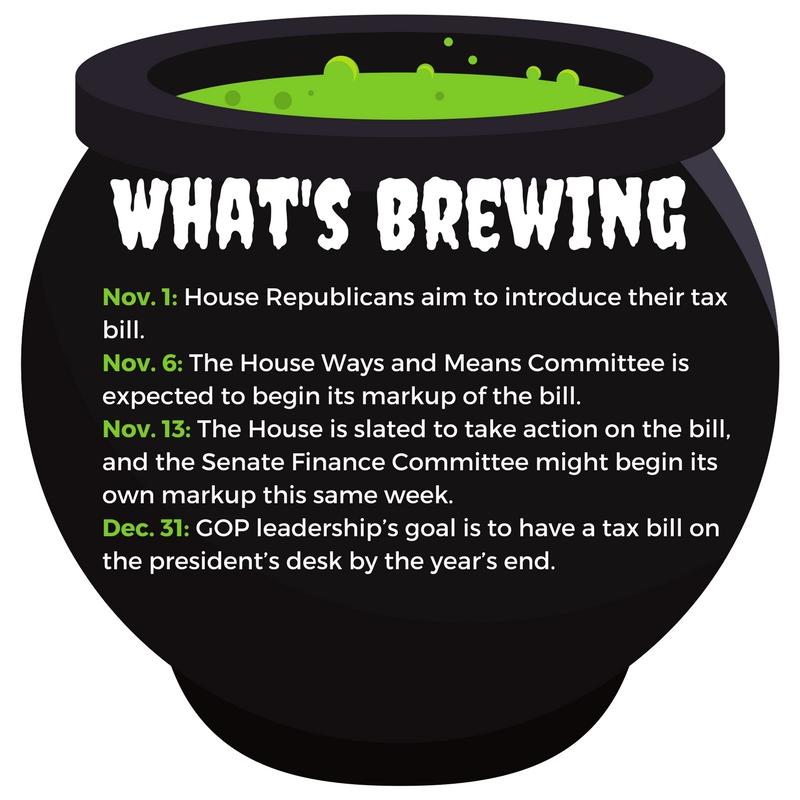

On October 26, the House celebrated Halloween early and passed the Senate’s scary version of the fiscal year 2018 Budget Resolution. Through a filibuster-proof, fast-track process called reconciliation, the House and Senate are considering a bone-chilling bill heavily tilted to provide trillions of dollars in tax cuts for the wealthy — cuts that come at the expense of programs that serve low-income people.

The Republican tax bill is terrifying because:

- Through reconciliation, Republicans do not need a single Democrat’s vote to pass the tax bill through the Senate.

- The bill drastically increases defense spending, likely without an equal increase in non-defense spending. This defies years of parity between defense and non-defense discretionary program funding that is outlined in the Budget Control Act of 2011.

- Although the Senate’s budget bill does not identify immediate cuts to human needs programs, ultimately, this bill, which is expected to reduce revenues by trillions of dollars, will be paid for by cuts to critical programs, such as the Supplemental Nutrition Assistance Program (SNAP), also known as food stamps.

This scenario has played out before. When the notion that tax cuts will pay for themselves doesn’t result in expected economic gains, critical programs — such as SNAP, school meals, Medicaid, and many others — will be targeted to address the deepening deficit.

Hunger anywhere in the U.S., for any group of people, is unacceptable. Rather than tax cuts heavily favoring the rich, and a downward path for help to the neediest among us, we need greater investments in proven and effective anti-hunger and anti-poverty programs.