Utility costs are rising across the country at a rate that many find unsustainable.1 For many households with low incomes, this means making tough decisions, choosing between putting food on the table and other essential household needs such as heating their homes during the winter months. The Supplemental Nutrition Assistance Program (SNAP), a critical program for lifting households out of poverty through a monthly benefit dedicated for food and beverage purchases, accounts for this decision by allowing households to deduct part of their utilities costs through a standard utility allowance, which varies from state to state. A new regulation from the U.S. Department of Agriculture (USDA) Food and Nutrition Service (FNS) makes an update to that allowance that will impact SNAP households.

Standard Utility Allowance

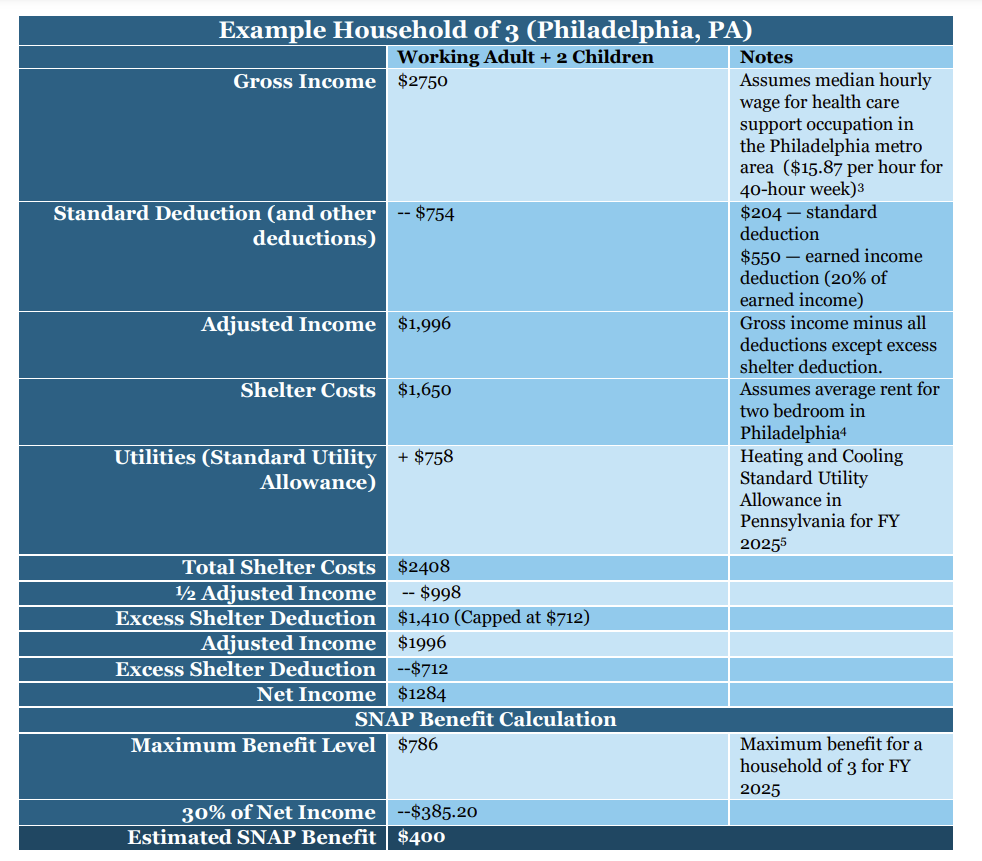

The Standard Utility Allowance (SUA) is part of the SNAP excess shelter deduction, ensuring SNAP eligibility formulas account for part of a household’s shelter expenses. This deduction allows households to claim rent or mortgage payments, costs for heating, electricity, and other utilities, and taxes or interest on the home. The excess shelter cost deduction is capped for households without an older adult or person with a disability at $712 in 48 States and the District of Columbia.2

To account for costs related to heating, electricity, and other utilities, and to simplify the application process for SNAP, states can allow households to claim a standard utility allowance in lieu of actual household utility costs. FNS regulations give state SNAP agencies responsibility in developing and updating SUAs annually. In the fiscal year (FY) 2022, 71.6 percent of SNAP households claimed some form of utility expense. In the graphic below, the SNAP formula is laid out to show where SUAs come in (about halfway through the chart).

2019 Rulemaking Efforts

In 2019, the Trump administration sought to standardize SUAs through federal rulemaking by requiring uniform methodologies for calculating SUAs across states. The proposed rule claimed it would address discrepancies in benefit amounts, but in reality, it threatened to cut $4.5 billion in SNAP benefits over five years. This would undermine the benefits of SNAP and exacerbate the struggle many SNAP households face in paying for the rising costs of both food and utilities.

The SUA remains a critical tool to ensure households’ SNAP benefits adequately reflect the rising cost of heating and cooling one’s home in each state. To that end, USDA FNS published a final rule, which will take effect January 17, 2025, to standardize how states calculate, update, and implement SUAs while preserving states’ flexibility to set SUAs at rates reflective of local utility costs. The final rule sets standards for methodologies for updates and implementation of SUA updates annually.

Additionally, the final rule adds basic internet costs as an allowable utility expense and allows states to create a basic internet allowance that incurs internet costs. This is critical as households increasingly rely on the internet for work, education, job searches, and everyday life.

Impact of the New Final Rule

The final rule takes effect in January, and states have until the next SNAP Cost of Living Adjustment, October 1, 2025, to implement updated SUAs and reporting methodologies for determining SUAs. This means new SUAs may go into effect in states between January 17 and October 1, 2025.

Certain households may be impacted differently by the new final rule. The rule may more significantly impact households with older adults or persons with a disability as they are not subject to a cap on their excess shelter deduction, and heating and cooling costs remain critical.

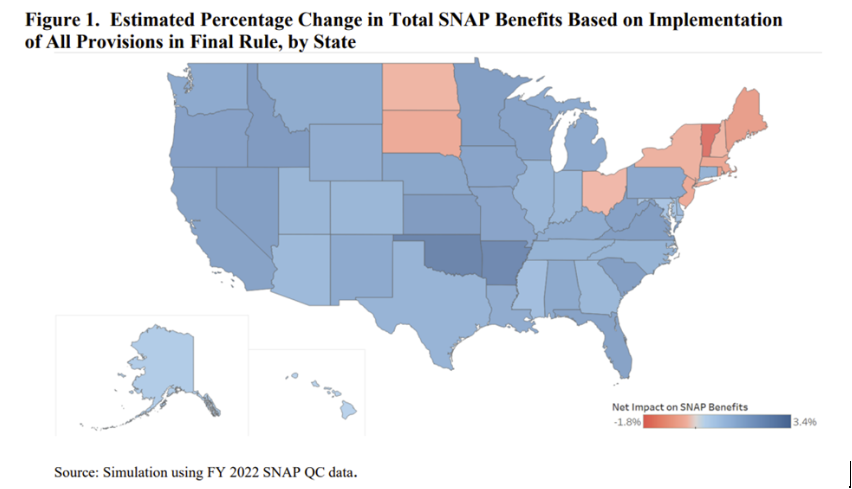

Households in some states as noted in the map below, particularly those with higher heating costs, will likely see a decrease in their SNAP benefits as the final rule resets SUAs slightly lower, and lower SUAs mean a smaller deduction from a household’s income when determining SNAP benefits. Many of these states will also see significantly more households maxing out their excess shelter cap deduction (as high as 29.4 percent of Rhode Island households compared to 14.3 percent nationally), likely due to high housing and heating costs in the winter.

| States With Highest Percentages of Households Hitting the Shelter Cap | |

| Rhode Island | 29.4 % |

| New York | 26.2 % |

| Vermont | 25.0 % |

| Connecticut | 23.3 % |

| Pennsylvania | 22.7 % |

What Anti-Hunger Advocates Can Do

1. Raise Awareness About SUA Updates

Advocates should help households understand the SUAs available to them and how changes to SUAs in your state may affect their SNAP benefits. In states that allow households to claim actual expenses, households should be encouraged to claim entire expenses if they are greater than the standard allowance they’d be eligible for.

Additionally, with the introduction of essential internet as an allowable utility expense, households should be informed about the potential benefits and how these allowances may affect their SNAP benefit levels. As states may implement updates at different times, advocates should ensure states are vigilant in keeping households aware of how these changes align with their financial needs.

2. Engage With State SUA Methodology Updates

Advocates should work with state agencies to review how SUAs are calculated and ensure methodologies reflect rising utility costs. Factors like increased utility usage due to natural disasters and other extreme climate events and higher utility rates must be accounted for. Resources, such as FNS’ 2017 report on SUA methods and data sources, offer valuable insights for ensuring SUAs remain accurate and equitable.

Webinar resource: Ensuring SNAP Benefit Adequacy: Toolkits for Advocates

3. Advocate for Removing the Shelter Deduction Cap

While SUAs are integral to the excess shelter deduction, their impact is often limited by the cap on this deduction, which 14.3 percent of SNAP households currently hit in FY 2022. Removing this cap, particularly in high-housing-cost states, would allow more households to receive adequate SNAP benefits to meet their needs. The Closing the Meal Gap Act (H.R. 3037/S. 1336) would permanently remove the cap on the excess shelter deduction, ensuring SNAP benefits adequately reflect households’ living expenses.

With food and utility costs continuing to rise, many SNAP households face impossible trade-offs between food, heating and cooling, and other essential utilities expenses. No one should be forced to choose between one or the other, especially in the richest nation in the world. The new SUA rule underscores the importance of SNAP in providing critical support for households with low incomes. As advocates and agencies prepare for these changes, collaboration, awareness, and policy engagement, are vital to ensuring each agency puts forward a SUA formula that considers the realities of rising costs of food and utilities faced by households with low incomes around the country.

References:

1 Cohen, L., Wholf, T. J., & Jurica, M. (2024, September 3). Electricity prices are on the rise. Is it inflation or an underlying issue? Retrieved from https://www.cbsnews.com/news/electricity-prices-rising-inflation-climate-change-clean-energy/

2 $1,137 in Alaska; $959 in Hawaii, $835 in Guam and $561 in the Virgin Islands; Food and Nutrition Service, & Johnston, M. (2024, August). SNAP – Fiscal Year 2025 Cost-of-Living Adjustments. Retrieved from https://fns-prod.azureedge.us/sites/default/files/resource-files/snap-cola-fy25.pdf